MACROECONOMY & END-USE MARKETS

Running tab of macro indicators: 8 out of 20

The number of new jobless claims rose by 2,000 to 230,000 during the week ending Sept 7. Continuing claims increased by 5,000 to 1.85 million, and the insured unemployment rate for the week ending August 31 was unchanged at 1.2%.

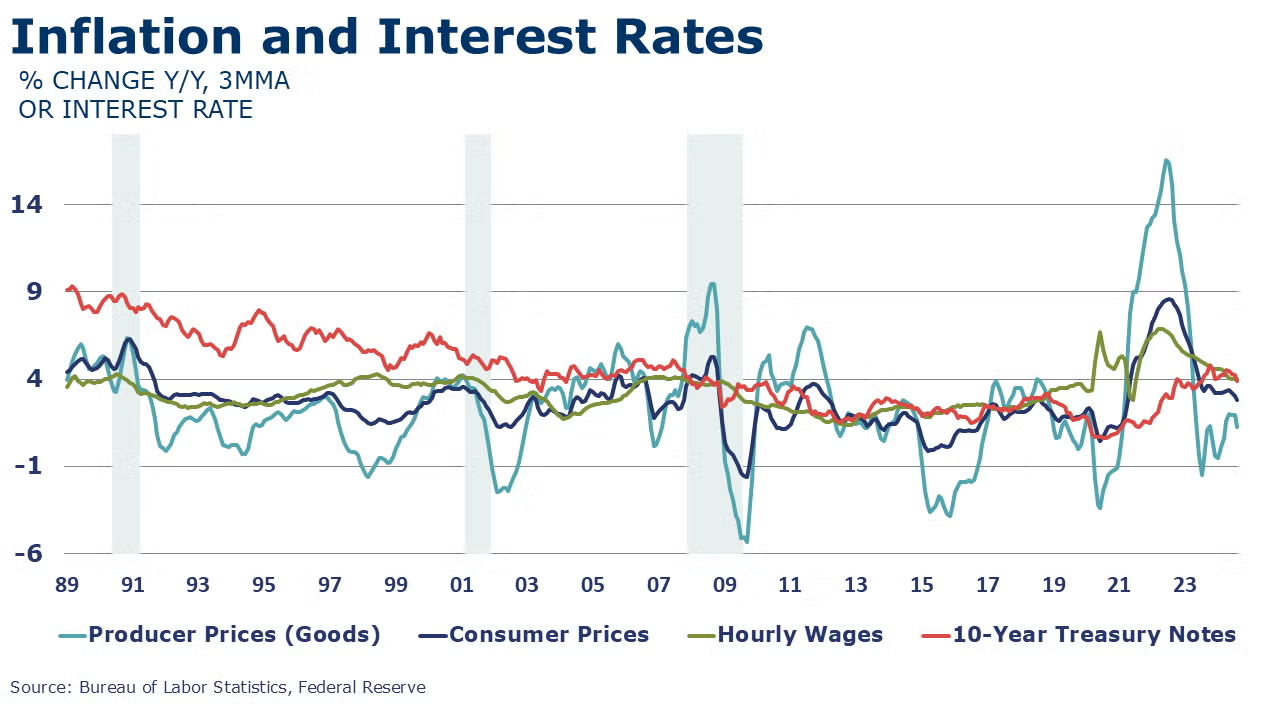

Consumer prices rose 0.2% in August, the same as in July. Excluding food and energy, core consumer prices were up by 0.3% with the contribution from shelter (including the much-debated imputed owners’ equivalent rent component) accounting for 70% of the increase in the “all items” index. Over the last 12 months, headline consumer prices were up 2.5% Y/Y and core prices were up 3.2% Y/Y, both at their lowest annual pace in more than three years.

Headline producer prices edged higher by 0.2% in August, as prices for services rose 0.4% and goods prices held steady. Excluding food and energy, core goods prices rose 0.3% in August, the same as in July. Headline producer prices have advanced 1.7% over the past 12 months and core prices (final demand less foods, energy, and trade services) have risen by 3.3%.

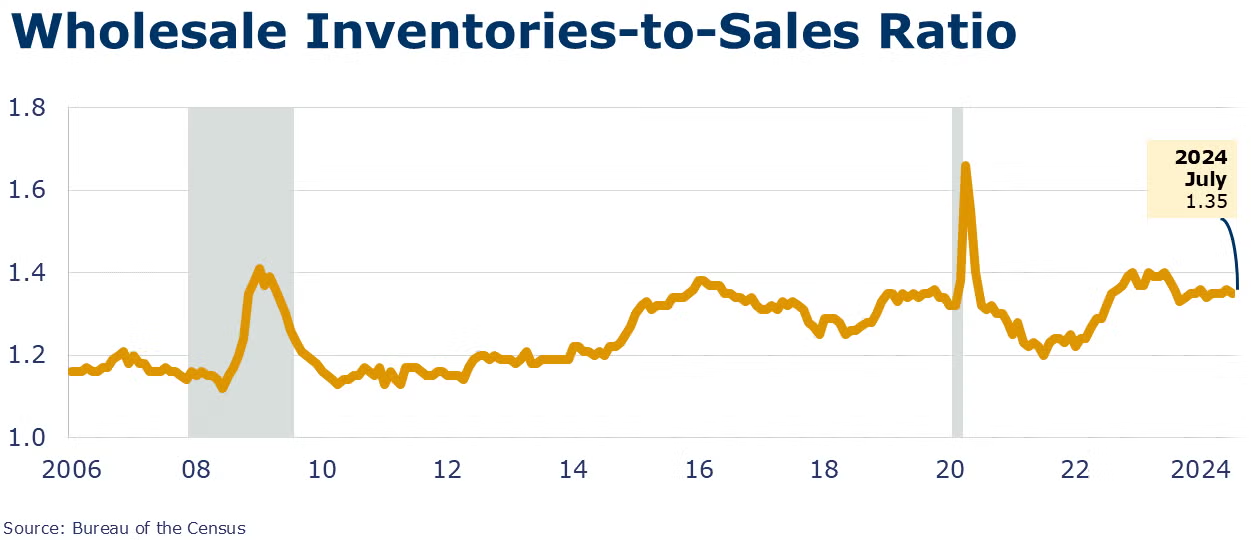

Wholesale sales rose in July and at a faster pace than the slight gain in inventories, pushing the inventories-to-sales ratio down a notch. Inventories rose by 0.2% in July and were up 0.4% Y/Y. The largest inventories gains occurred in pharmaceuticals, autos and parts, and professional equipment. Inventories were drawn down notably in metals, petroleum, and machinery. Wholesale sales were up 1.1% in July and up 2.9% Y/Y. The gain was driven by higher sales of petroleum. The inventories-to-sales ratio declined from 1.36 to 1.35 in July, lower than last year’s 1.38.

ENERGY

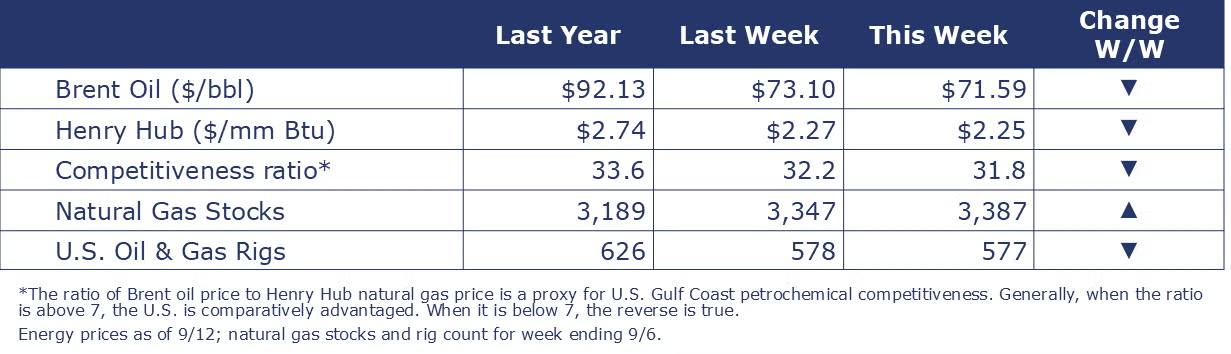

A look at energy data as of Thursday morning shows Brent oil prices down so far this week and lower than the same time last year. Henry Hub natural gas prices also eased (though less so) and are lower than last year. As a result, the competitiveness ratio was lower at 31.8. Natural gas stocks were up and the U.S. oil and gas rig count was down by 1 to 577 and down from 626 last year.

CHEMICALS

Indicators for the business of chemistry suggest a yellow banner.

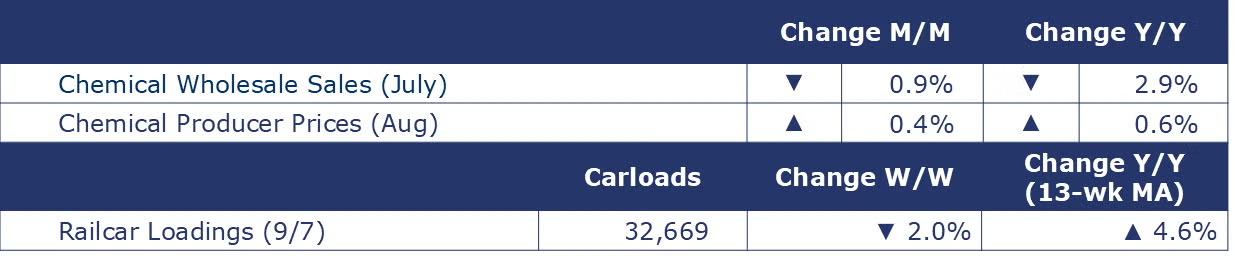

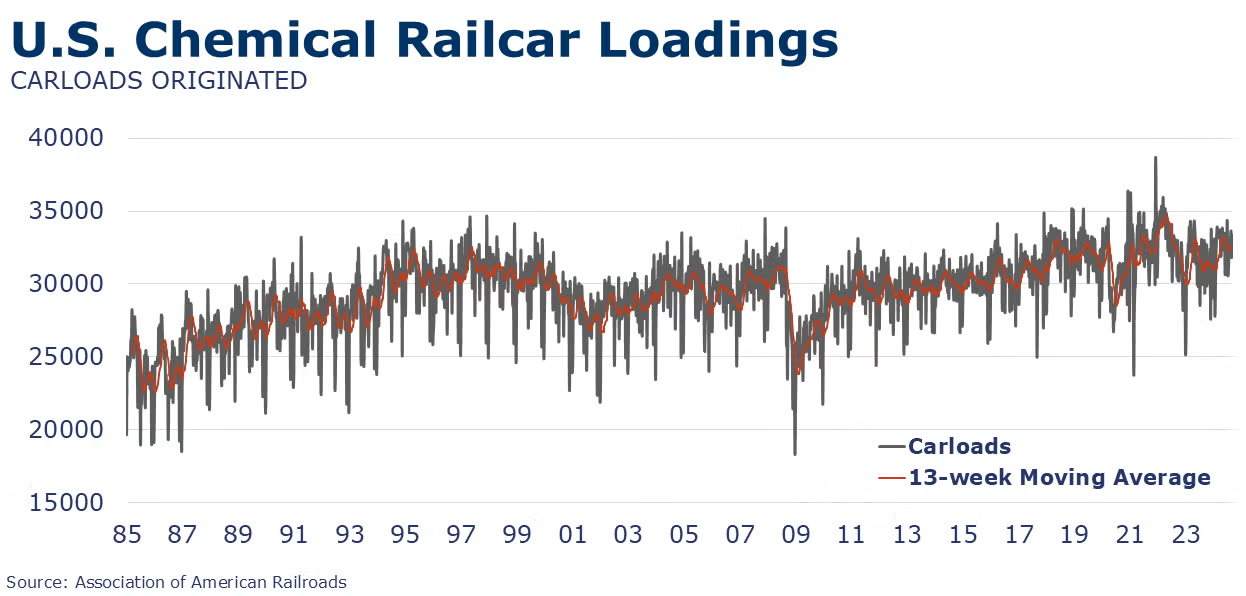

According to data released by the Association of American Railroads, chemical railcar loadings were down to 32,669 for the week ending Sept 7. Loadings were up 4.6% Y/Y (13-week MA), up (4.4%) YTD/YTD and have been on the rise for 8 of the last 13 weeks.

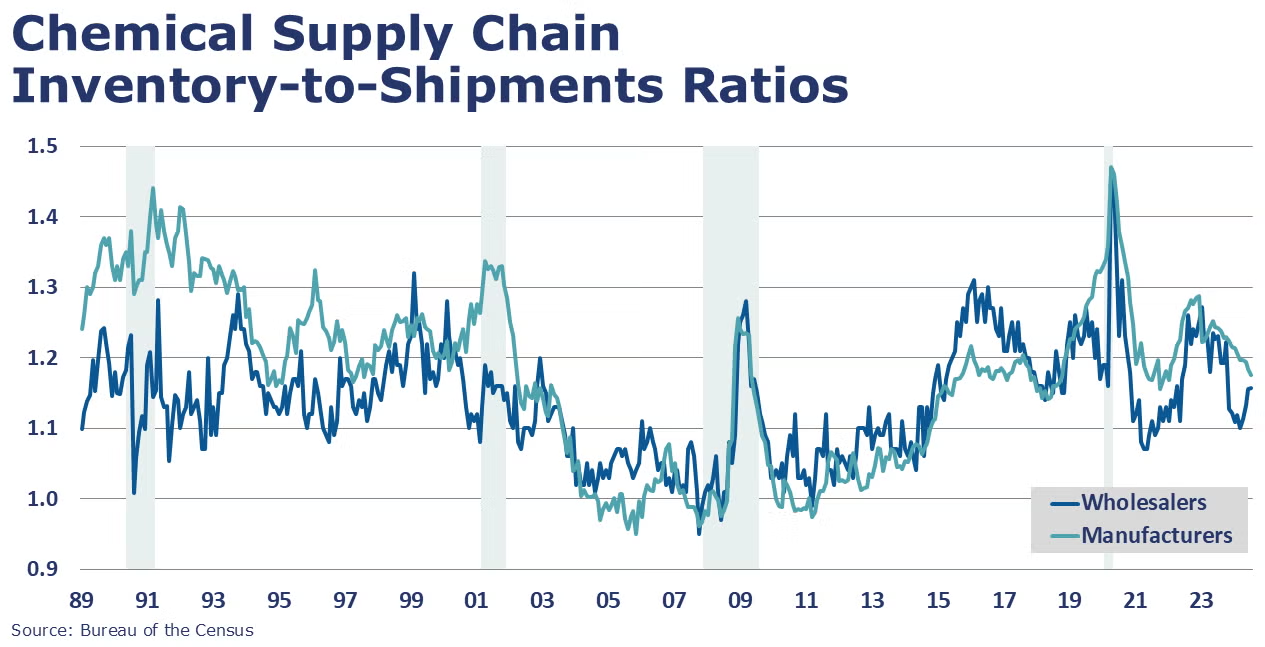

Both inventories and sales at the wholesale level fell in July. Sales of chemicals fell 0.9% in July to $12.7 billion. Wholesale inventories were drawn down 0.9% by the end of the month. The inventories-to-sales (I/S) ratio rose held steady at 1.16 in July, lower than the 1.23 I/S ratio in July 2023. Compared to a year ago, chemical wholesale inventories were down 8.8% Y/Y while sales were off 2.9% Y/Y.

Producer prices for chemicals rose 0.4% in August, the fourth consecutive monthly gain, and were 0.6% higher on a Y/Y comparison. Prices were higher for consumer products, bulk petrochemicals and organics, plastic resins, manufactured fibers, coatings and other specialty chemicals. These gains were partially offset by lower prices for inorganic chemicals, synthetic rubber, and agricultural chemicals. Feedstock prices eased by 3.2% during August but were up by 31.1% Y/Y.

Note On the Color Codes

Banner colors reflect an assessment of the current conditions in the overall economy and the business chemistry of chemistry. For the overall economy we keep a running tab of 20 indicators. The banner color for the macroeconomic section is determined as follows:

Green – 13 or more positives

Yellow – between 8 and 12 positives

Red – 7 or fewer positives

There are fewer indicators available for the chemical industry. Our assessment on banner color largely relies upon how chemical industry production has changed over the most recent three months.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange.

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.