MACROECONOMY & END-USE MARKETS

Running tab of macro indicators: 10 out of 20

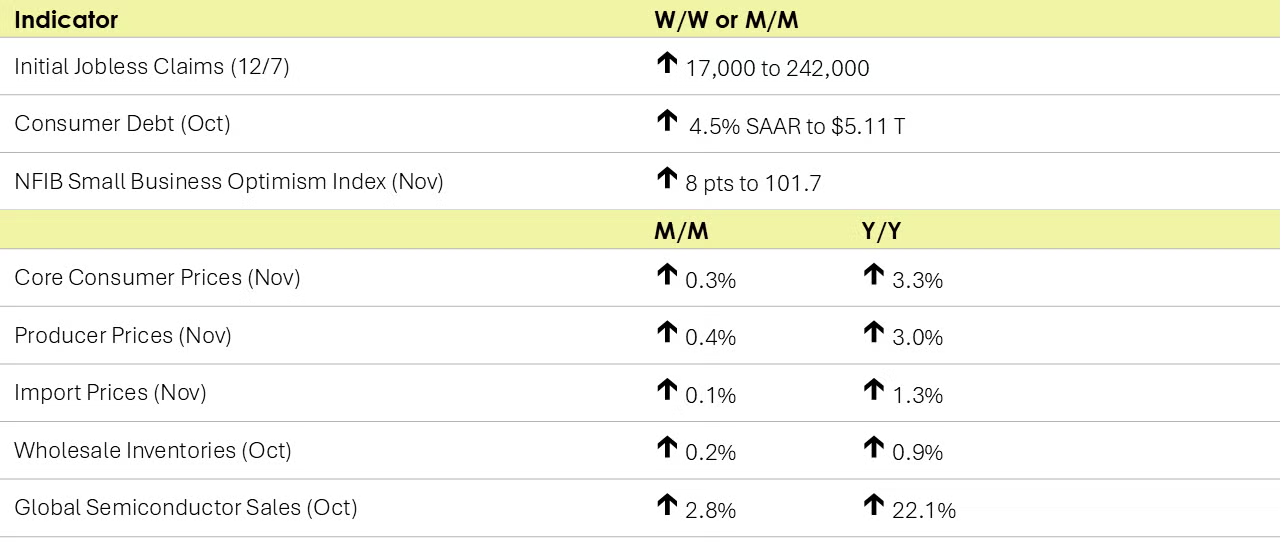

The number of new jobless claims rose by 17,000 to 242,000 during the week ending December 7. Continuing claims increased by 15,000 to 1.886 million, and the insured unemployment rate for the week ending November 30 was unchanged at 1.2%.

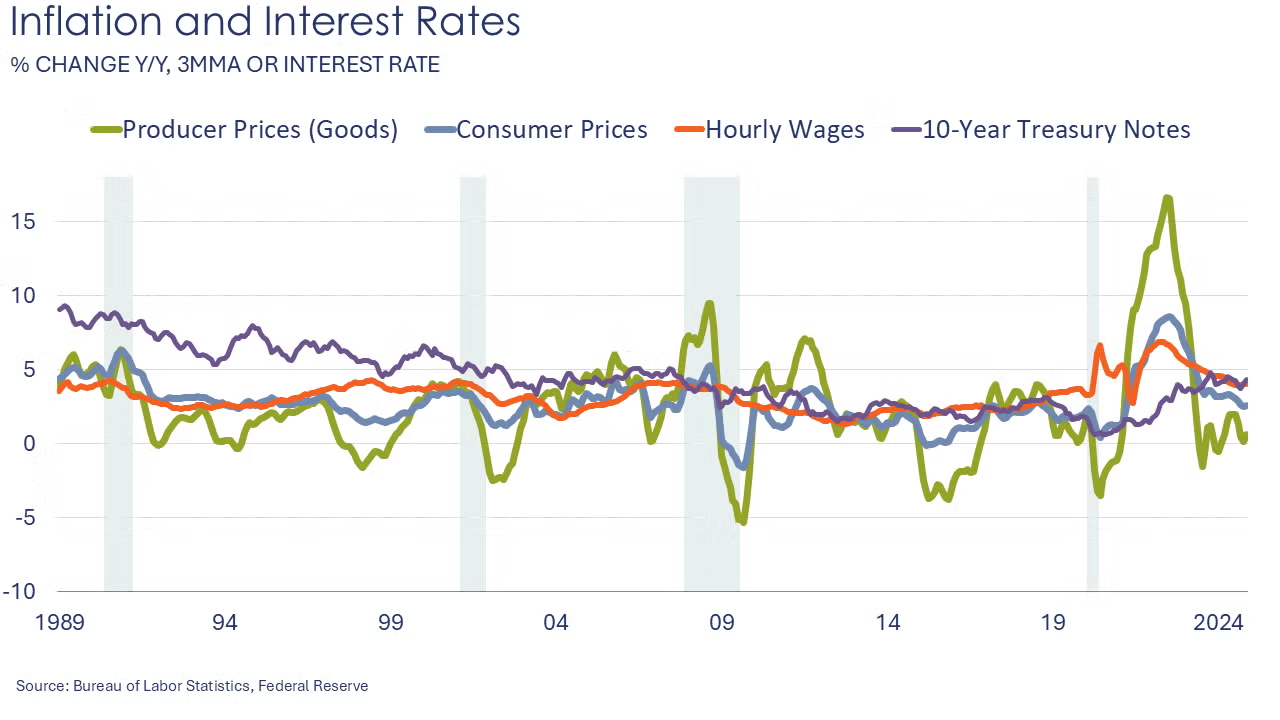

Consumer prices advanced 0.3% in November, the fastest pace since April and up 2.7% Y/Y (a higher annual pace compared to October). Food prices picked up as did energy prices, including gasoline. Housing-related costs rose in November, accounting for 40% of the overall advance in inflation and were up 4.7% Y/Y. Core inflation rose 0.3% in November and was up 3.3% Y/Y.

U.S. import prices edged up slightly (just 0.1%) in November and were up 1.3% Y/Y. Import fuel prices advanced 1.0% in November following a 0.8% decline the previous month. Higher prices for natural gas and petroleum in November contributed to the increase in import fuel prices. Despite the November rise, prices for import fuel declined 8.6% over the past 12 months. Excluding fuel, nonfuel import prices were unchanged in November. Export prices were unchanged in November and up 0.8% Y/Y. Prices for agricultural exports declined while prices for non-agricultural exports edged up 0.1%.

Producer prices also moved higher in November, up 0.4%. Prices for final demand goods jumped by 0.7%, led by higher prices for foods. A quarter of the gain in the index for final demand goods was from sharply higher prices for chicken eggs due to recent outbreaks of bird influenza. Core goods prices were up 0.2%. Services prices rose at a more moderate pace than in recent months. Compared to a year ago, headline producer prices were up 3.0% Y/Y, its highest annual gain since February 2023, while core PPI was up 3.5% Y/Y, the same as in October.

Following modest gains in the previous two months, non-mortgage consumer debt rose at a 4.5% annual rate to $5.11 trillion in October. While non-revolving debt (i.e., student loans and car loans) edged higher, revolving debt (primarily credit cards) surged at a 13.9% annual rate. This was the fastest monthly gain in nearly two years and may reflect retail discounting and early holiday shopping.

Wholesale inventories rose 0.2% in October, reversing a decline in September. The largest gains in inventories were in computer equipment, furniture and groceries. The largest declines were in petroleum products, farm products, and electrical equipment. Wholesale sales edged lower by 0.1% with the largest declines in computer and professional equipment, metals and apparel. Wholesale sales were higher in electrical equipment, furniture, groceries and farm products. The inventories-to-sales ratio remained stable at 1.34 (compared to both September and last October). Compared to a year ago, both sales and inventories were 0.9% higher.

Small business optimism rose 8 points to 101.7 in November following 34 months of index readings below the 50-year average of 98. A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months. Inflation remains the top issue followed closely by quality of labor. NFIB commented that the boost to optimism was “clearly a response to the presidential election” and that “the election results signal a major shift in economic policy, particularly for tax and regulation policies, that favor economic growth.”

Global semiconductor sales rose 2.8% in October to a record high of $56.9 billion. Sales were up 22.1% Y/Y. In addition, a new World Semiconductor Trade Statistics upwardly revised its 2024 forecast to a 19.0% gain in global semiconductor sales. In 2025, sales are forecast to grow by 11.2% with the strongest growth in the Americas.

ENERGY

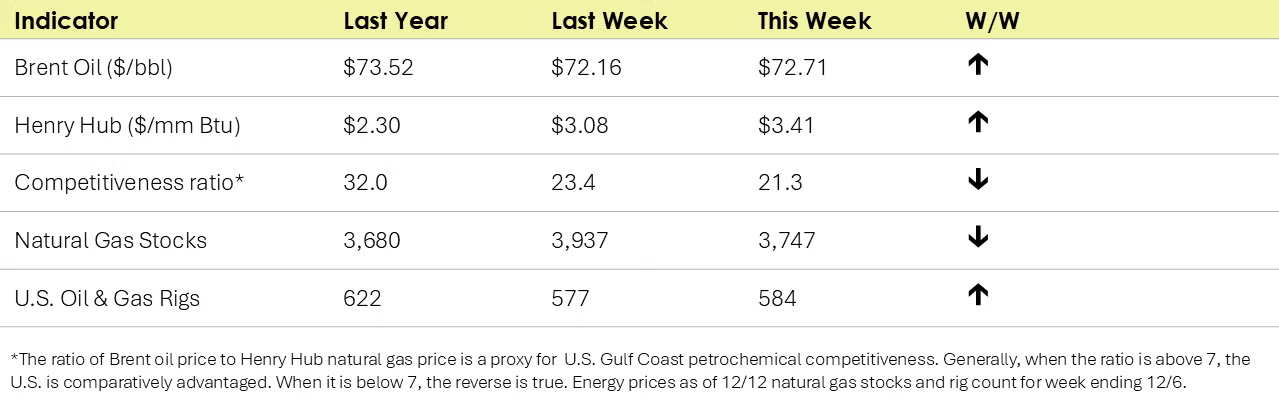

Oil prices rose after China announced new monetary policy stimulus and new EU sanctions against Russia and possibly new sanctions from the U.S. U.S. natural gas prices were also higher on colder temperatures. Gas inventories remain ample going into mid-December, however. The combined oil and gas rig count rose by seven to 584, the first weekly gain in nearly two months.

CHEMICALS

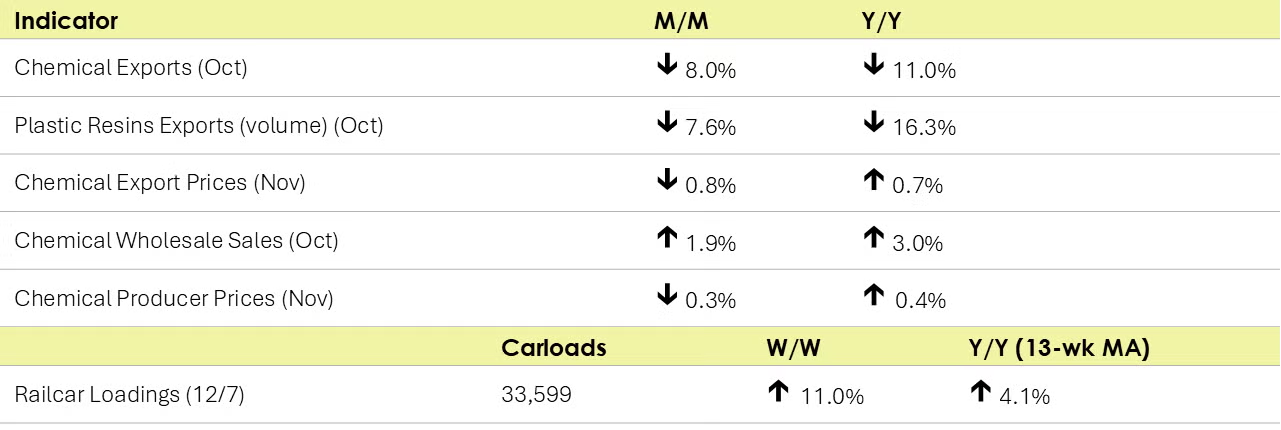

Indicators for the business of chemistry suggest a yellow banner.

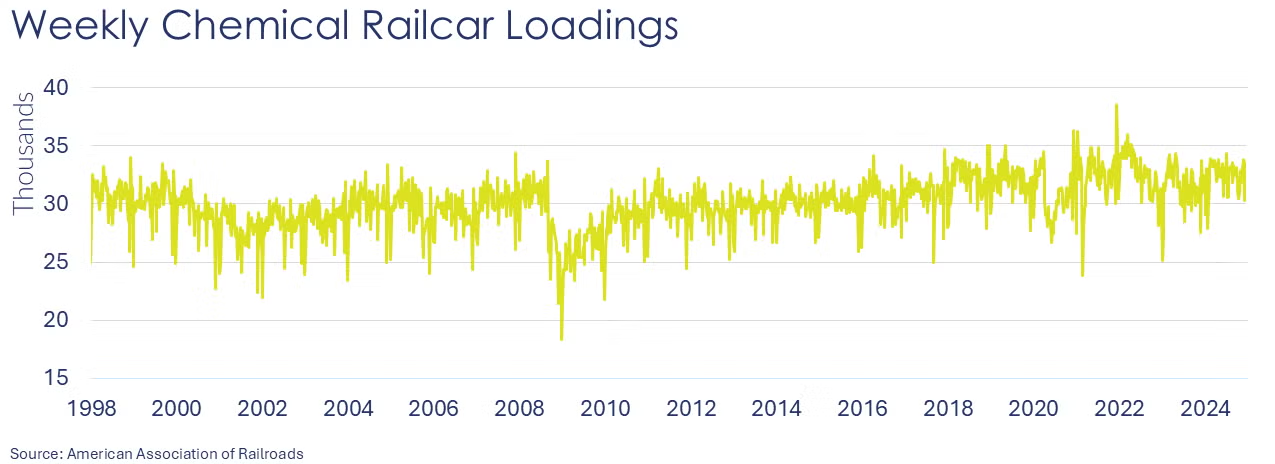

According to data released by the Association of American Railroads, chemical railcar loadings were up to 33,599 for the week ending December 7. Loadings were up 4.1% Y/Y (13-week MA), up (4.1%) YTD/YTD and have been on the rise for 6 of the last 13 weeks.

Chemical producer prices fell 0.3% in November, following a 0.6% gain in October. There were gains in the prices of inorganic chemicals, agricultural chemicals, coatings and other specialty chemicals. Prices for bulk petrochemicals & organics, plastic resins, synthetic rubber, manufactured fibers and consumer products were lower. Feedstock costs were 3.9% higher. Compared to a year ago, chemical prices were slightly higher, by 0.4%, the first Y/Y gain in 19 months.

Following a 0.9% gain in September, sales of chemicals at the wholesale level fell 1.9% in October. Chemical inventories also fell, down by 0.2%. The inventories-to-sales ratio edged higher from 1.18 in September to 1.20 in October. A year ago, the ratio was 1.21. Compared to last October, sales were off 3.0% Y/Y while inventories were down 3.8% Y/Y.

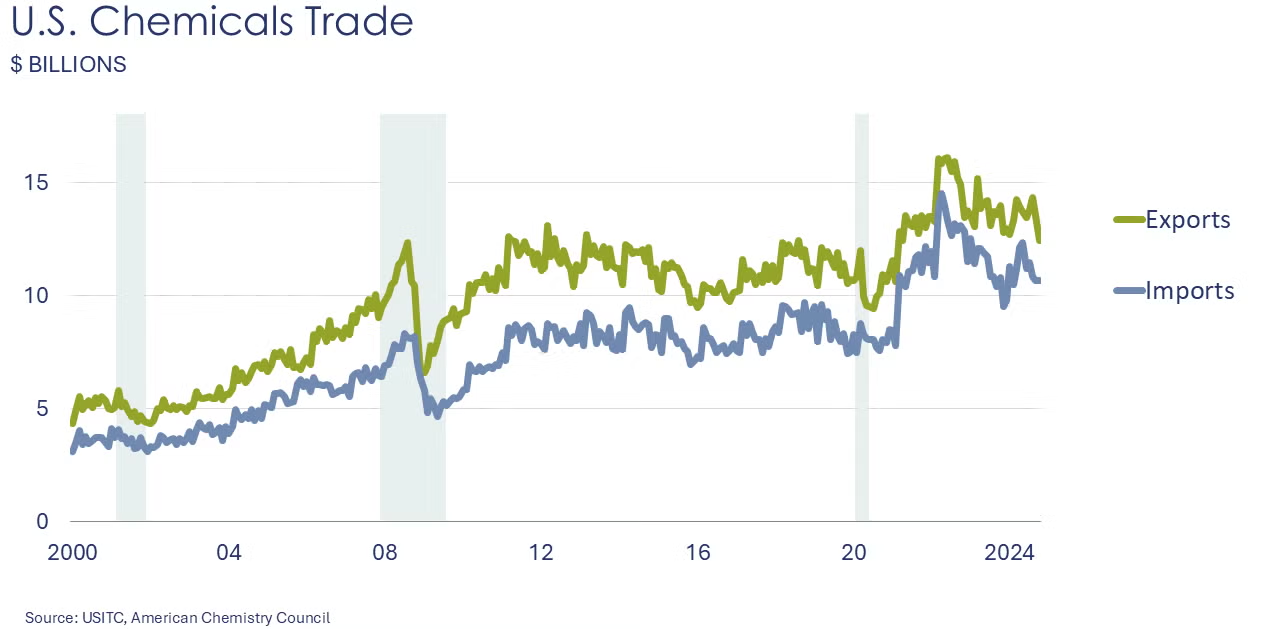

U.S. chemical exports were down 8.0% in October reflecting declines in all categories except adhesives and sealants. Chemical imports were up by 0.1% as declines in basic chemicals were offset by gains across all other categories. The U.S. chemicals trade surplus dropped to $1.8 billion in October and is $23.2 billion YTD. Compared to the same month last year, exports were down 11.0% Y/Y and imports were down 0.8% Y/Y.

U.S. plastic resins exports declined by 10.1% in October to a level down 8.4% Y/Y on a USD$ value basis. On a volume comparison, at 1.7 million metric tons exported in October, plastic resins exports were down 7.6% from September and down 16.3% Y/Y.

Prices for imported chemicals fell 0.4% in November and were down 1.4% Y/Y. Prices for chemical exports fell 0.8% and were up 0.7% Y/Y.

Note On the Color Codes

Banner colors reflect an assessment of the current conditions in the overall economy and the business chemistry of chemistry. For the overall economy we keep a running tab of 20 indicators. The banner color for the macroeconomic section is determined as follows:

Green – 13 or more positives

Yellow – between 8 and 12 positives

Red – 7 or fewer positives

There are fewer indicators available for the chemical industry. Our assessment on banner color largely relies upon how chemical industry production has changed over the most recent three months.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange.

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.