MACROECONOMY & END-USE MARKETS

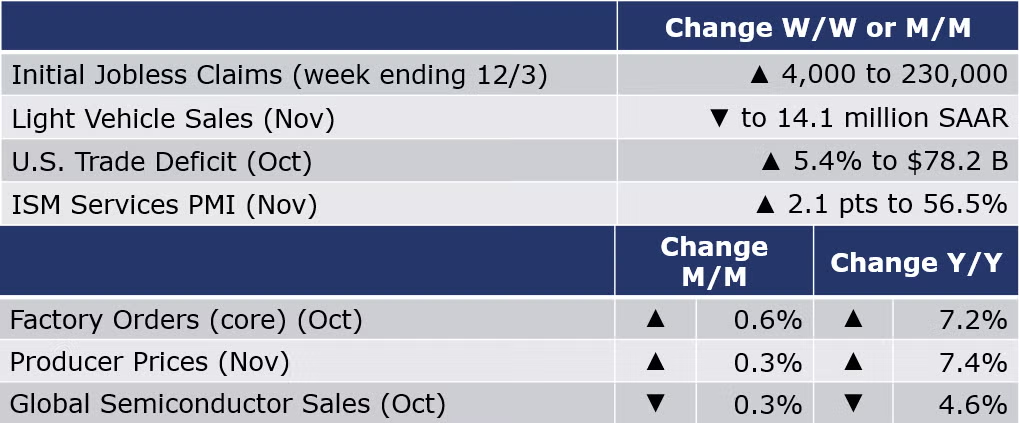

Running tab of macro indicators: 8 out of 20

The number of new jobless claims rose by 4,000 to 230,000 during the week ending 3 December. Continuing claims increased by 62,000 to 1.67 million, and the insured unemployment rate for the week ending 26 November rose 0.1% to 1.2%.

Following similar increases in September and October, producer prices continued to move higher in November, up by 0.3%, higher than expected. A decline in prices for energy goods and transportation & warehousing services was offset by higher prices for foods, trade margins and other goods and services. Excluding the volatile food and energy components, core producer prices also rose by 0.3% during the month, suggesting that underlying price pressures are continuing to build. Headline producer prices were up by 7.4% Y/Y while core prices were up 4.9% Y/Y, still too high, but both measures indicate a deceleration of price increases. The report comes as the Fed gets ready to meet again next week to determine the next rate increase.

The U.S. goods and services trade deficit rose 5.4% in October to $78.2 billion as exports fell and imports rose. Exports dropped by 0.7%, while imports increased by 0.6% in October. Export weakness was broad-based in goods across industrial supplies and materials and consumer goods. Increases in exports of crude oil, animal feeds and travel and transport services were not enough to offset decreases in natural gas and pharmaceutical products. Imports of goods increased as travel and transport services fell. Much of the growth in imports was from industrial supplies and automotive vehicles and parts.

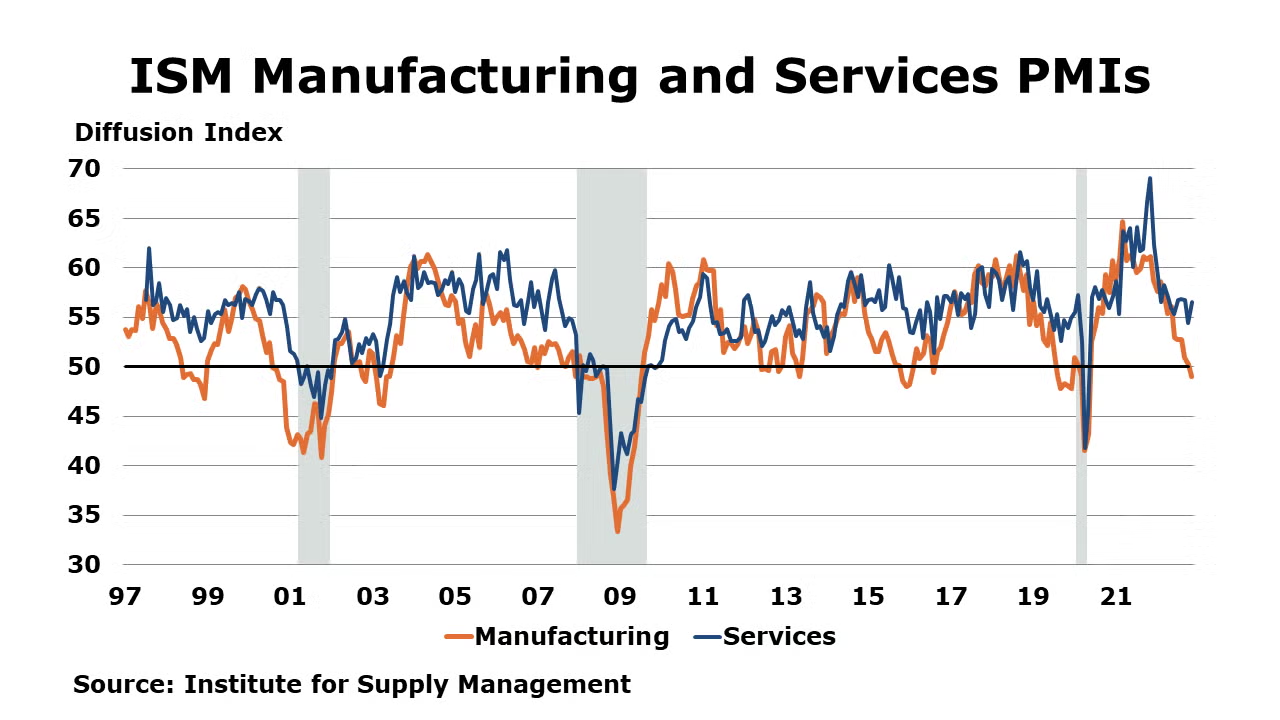

According to the Institute for Supply Management (ISM), the Services PMI® for November registered 56.5%, 2.1 percentage points higher than in October. Most (13 out of 18) U.S. non-manufacturing industries reported growth due to increases in business activity and employment. Supplier deliveries, despite being at a slower pace, continued their upward momentum. Based on comments from Business Survey Committee respondents, increased capacity and shorter lead times have resulted in further improvement in supply chain and logistics performance.

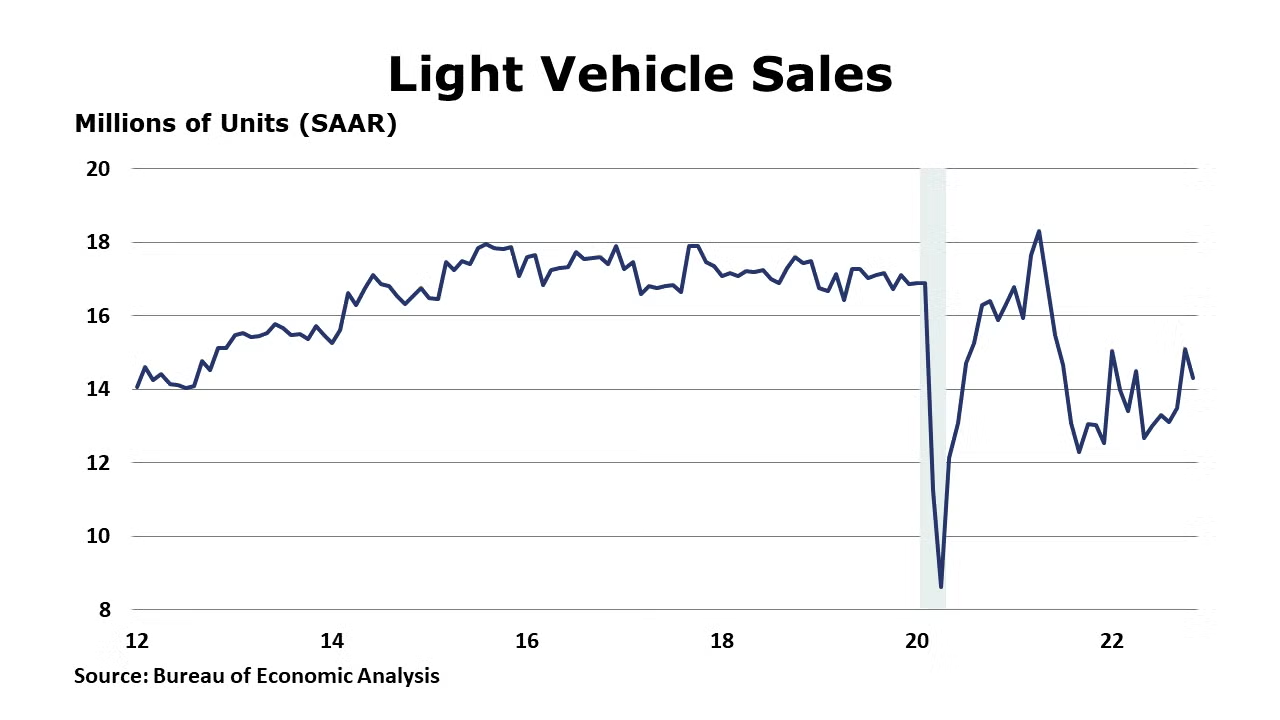

Following a jump to a 15.1 million unit seasonally adjusted annual rate (SAAR) in October, light vehicle sales eased to a 14.1 million SAAR in November. Recent improvements in the availability of computer chips have led to higher rates of vehicle assemblies. The rising cost of borrowing, however, may be tempering demand for vehicles.

Nominal factory orders continued to expand in October, up by 1.0%, with broad gains across major categories. The largest gains were in computers and related products and defense capital goods. There were also gains in new orders for consumer nondurables, motor vehicles & parts, and ICT equipment. New orders for construction materials and supplies, which have been week much of the year, edged marginally higher. Core business orders were up 0.6%. A measure of the manufacturing pipeline, unfilled orders continued to expand, up by 0.6%. Manufacturing shipments rose 0.7% and inventories were up 0.5%. The inventories-to-shipments ratio remained steady (compared to September) at 1.45. A year ago, the ratio was 1.50.

Global semiconductor industry sales were down slightly (0.3%) M/M to $46.9 billion in October. Sales were down 4.6% Y/Y globally but were up 11.4% Y/Y in the Americas.

ENERGY

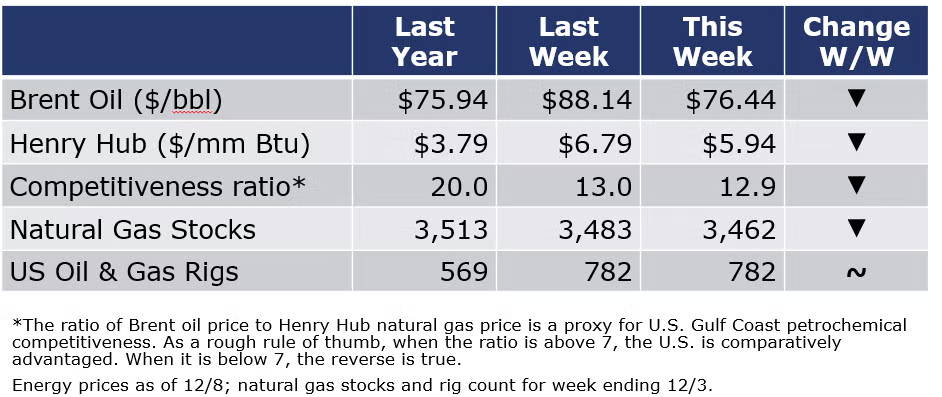

Oil prices eased compared to a week ago and are now at their lowest level of 2022. Growing concern about a recession in 2023 offset several factors which would normally raise oil prices, including a shutdown of the Keystone pipeline, relaxed COVID restrictions in China, and Sunday’s announcement from OPEC+ that it would maintain its previously announced production cut of 2 million BPD. U.S. natural gas prices were lower from a week ago and U.S. natural gas inventories are only slightly below normal for this time of the year. The combined oil and gas rig count was steady at 782 rigs during the week ending 12/3.

CHEMICALS

For the business of chemistry, the indicators still bring to mind a yellow banner for basic and specialty chemicals.

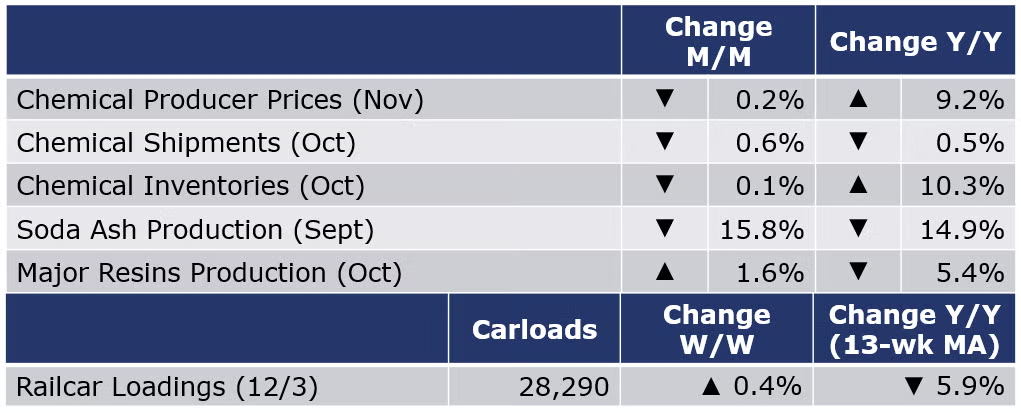

According to data released by the Association of American Railroads, chemical railcar loadings were up 0.4% W/W to 28,290 for the week ending 3 December. Loadings were down 5.9% Y/Y (13-week MA), up 1.0% YTD/YTD and have been on the rise for 6 of the last 13 weeks.

Producer prices for chemical products edged lower for a fifth consecutive month in November, down by 0.2%. Gains in prices for inorganic chemicals, consumer products, agricultural products, petrochemicals, coatings and other specialty chemicals were offset by lower prices for plastic resins, synthetic rubber, and manufactured fibers. Compared to a year ago, chemical prices were up by 9.2% Y/Y

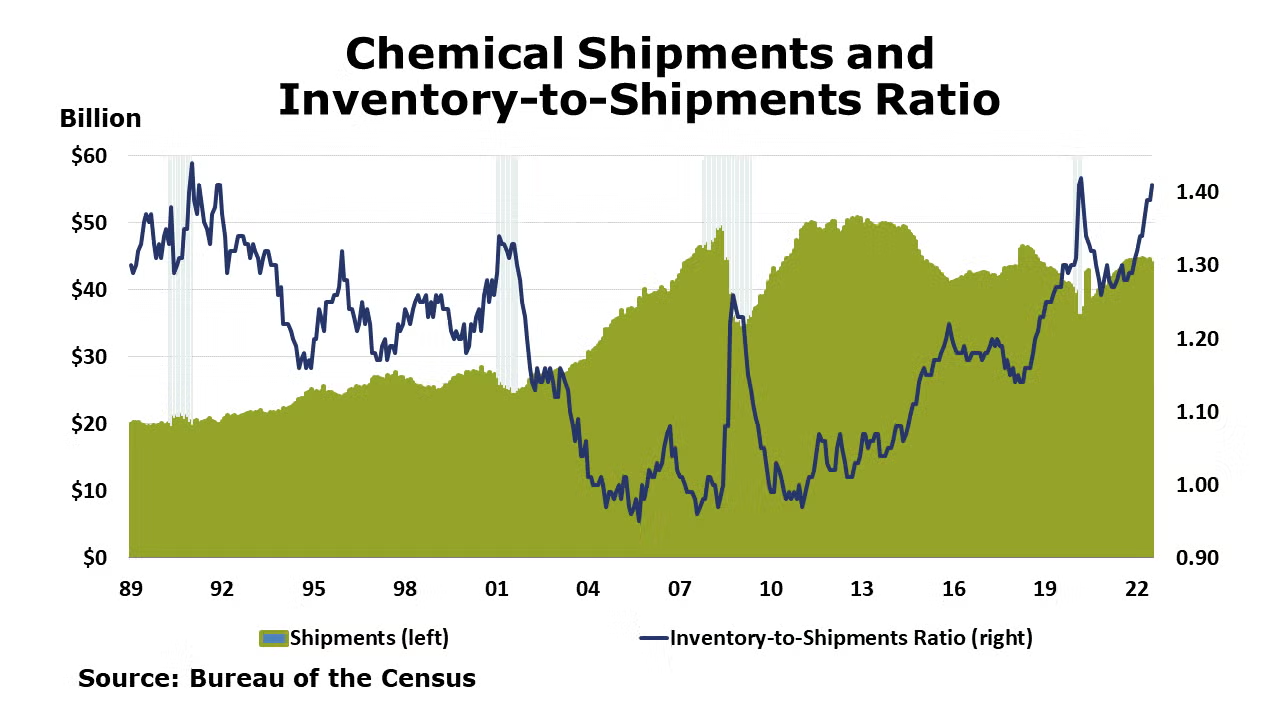

Chemical shipments were lower for a second month in October, off by 0.6%. Higher shipments of agricultural chemicals, adhesives, and coatings were more than offset by lower shipments of other chemicals. Chemical inventories were essentially unchanged (off by 0.1%), following nearly two years of sequential gains. Inventories of coatings and adhesives continued to expand but were offset by lower inventories of agricultural and other chemicals. Data on shipments and inventories are in nominal terms and do not reflect price changes. Compared to a year ago, chemical shipments were off by 0.5% (the first negative Y/Y comparison since the end of 2020), while inventories were up 10.3% Y/Y. The inventories-to-shipments ratio for chemicals remained stable at 1.41 (compared to September) but was up from 1.28 a year ago.

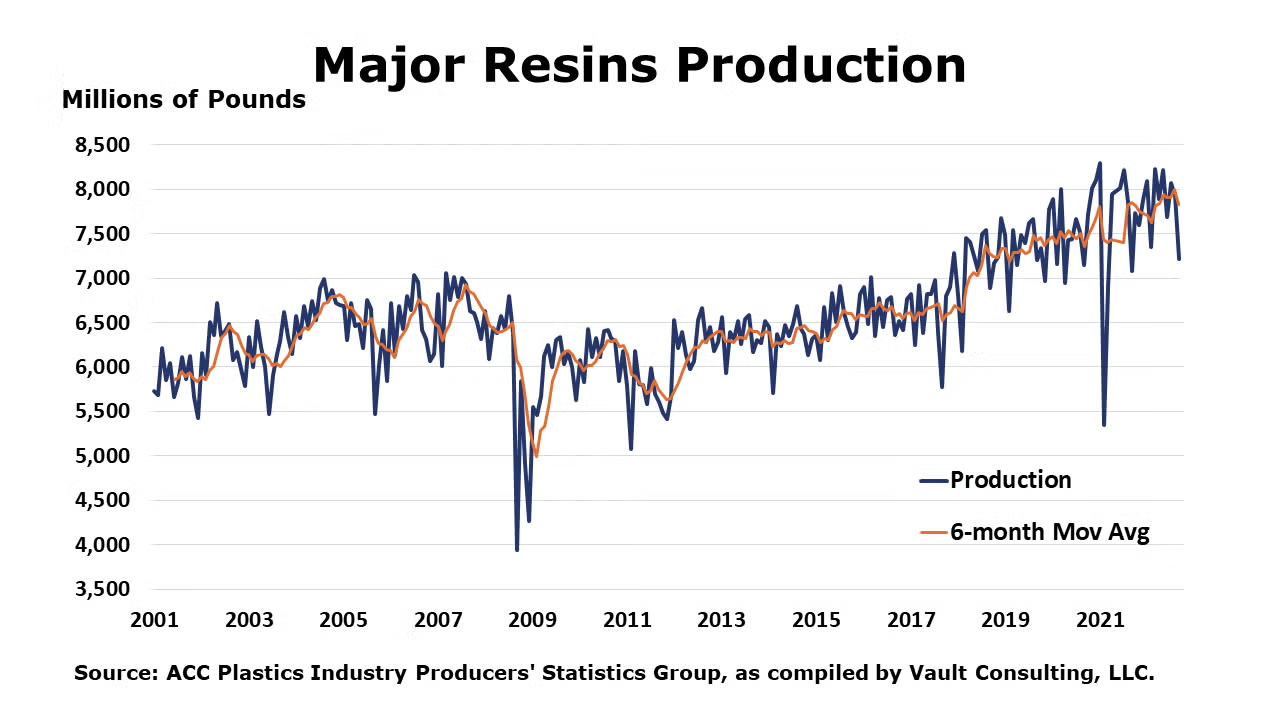

U.S. production of major plastic resins totaled 7.3 billion pounds during October 2022, up 1.6% M/M and down 5.4% Y/Y, according to statistics released by the ACC. Year-to-date production was 78.1 billion pounds, up 3.4% Y/Y. Sales and captive (internal) use of major plastic resins totaled 7.3 billion pounds, down 4.7% M/M and down 1.2% Y/Y. Year-to-date sales and captive use were 77.6 billion pounds, up 4.7% Y/Y.

The U.S. Geological Survey reported that monthly production of soda ash in September was 797 thousand tons, down 15.8% compared to the previous month and down 14.9% Y/Y. Several companies reported shutdowns of some production units in September resulting in the lower production levels for the month. Stocks fell 0.4% compared to August to 236 thousand tons at the end of the month, a 9-day supply. Ending stocks were up 10.3% Y/Y.

Note On the Color Codes

The banner colors represent observations about the current conditions in the overall economy and the business chemistry. For the overall economy we keep a running tab of 20 indicators. The banner color for the macroeconomic section is determined as follows:

Green – 13 or more positives

Yellow – between 8 and 12 positives

Red – 7 or fewer positives

For the chemical industry there are fewer indicators available. As a result we rely upon judgment whether production in the industry (defined as chemicals excluding pharmaceuticals) has increased or decreased three consecutive months.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through MemberExchange.

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com