Running tab of macro indicators: 10 out of 20

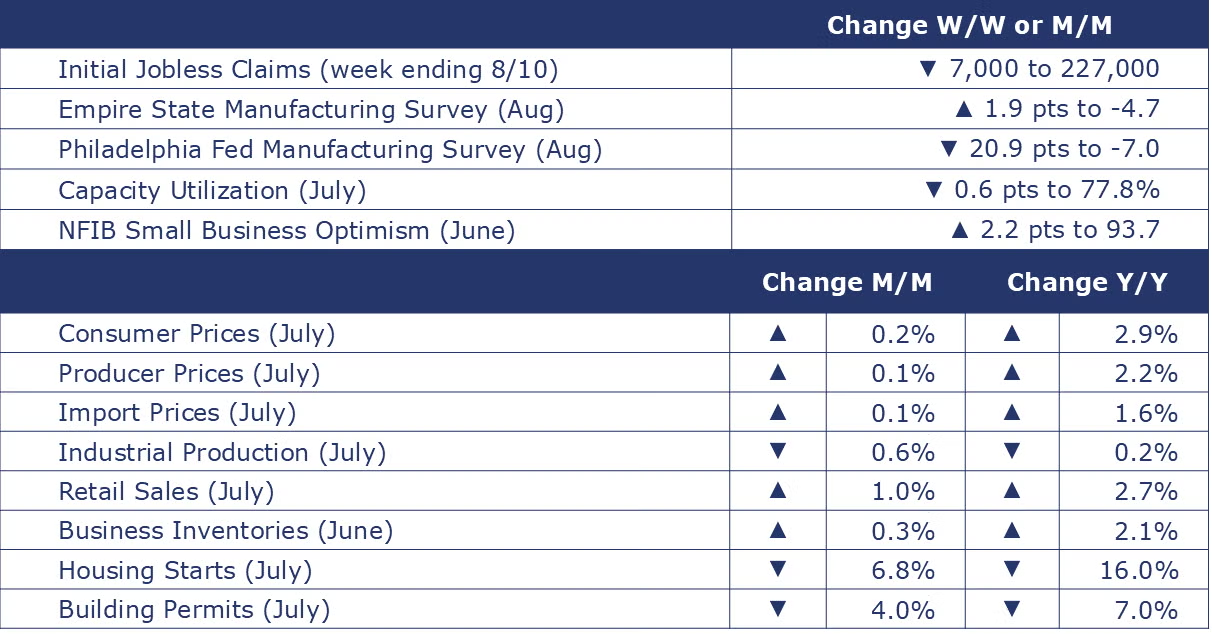

The number of new jobless claims fell by 7,000 to 227,000 during the week ending August 10th. Continuing claims also fell by 7,000 to 1.86 million, and the insured unemployment rate for the week ending August 3rd was unchanged at 1.2%.

Retail sales rebounded in July, up by 1.0%. While much of the gain was from auto sales which bounced back following a cyberattack that disrupted dealerships around the country in June, there were broad gains across other segments. Sales excluding motor vehicles were up by 0.4%. There were gains in the sales of building materials and garden centers; food & beverage stores; general merchandise stores; electronics & appliance stores; and furniture & home furnishing stores. Restaurant sales also rose, as did online platform sales. These gains were only partially offset by lower sales at sporting goods & hobby stores; clothing & accessory stores; and miscellaneous retailers. Compared to a year ago, sales were up 2.7% Y/Y.

Headline consumer prices rose 0.2% in July following a modest (0.1%) decline in June. Excluding food and energy, core consumer prices were also up by 0.2% with the contribution from shelter (including the much-debated imputed owners’ equivalent rent component) accounting for 90% of the increase in the “all items” index. Compared to a year ago, headline consumer prices were up 2.9% Y/Y and core prices were up 3.2% Y/Y, both at their lowest annual pace in more than three years.

Headline producer prices edged higher by 0.1% in July, a smaller gain than expected, due in large part to declining prices for services. Led by lower prices for trade services (i.e., margins), prices for final demand services fell 0.2%, the largest decline since March 2023. Goods prices continued to move higher. Excluding food and energy, core goods prices rose 0.2%, up from June. Compared to a year ago, headline producer prices were up 2.2% Y/Y and core prices were up 3.3% Y/Y.

Import prices edged higher in July with a modest 0.1% gain at both the headline and core levels. Export prices, however, rose by 0.7%, led by higher prices for nonagricultural industrial supplies and materials; automotive vehicles; consumer goods; and nonagricultural foods. Compared to a year ago, export prices were up 1.6% Y/Y while export prices were up 1.4% Y/Y.

Combined business inventories of manufacturers, wholesalers, and retailers rose 0.3% in June following a 0.5% gain in May. Gains in retail and wholesale inventories offset flat growth in manufacturing inventories. Combined business sales eased by 0.1% after no change in May. Sales at manufacturers were higher but were offset by lower wholesale and retail sales. Compared to a year ago, business inventories were up 2.1% while sales were up 2.2% Y/Y. The inventories-to-sales ratio remained unchanged from May at 1.38. It also remained unchanged from a year ago.

Following a gain in June, housing starts fell back in July, down 6.8% to a 1.238 million seasonally adjusted annual rate (SAAR), the lowest pace since May 2020. Single-family starts tumbled 14.1%. Forward-looking building permits also fell, down by 4.0%, led by a large decline in permits for multifamily. Building permits for single-family construction eased by only 0.1%. Compared to a year ago, building permits were down 7.0% Y/Y while housing starts were off by 16.0% Y/Y.

According to the NAHB/Wells Fargo Housing Market Index, homebuilder confidence continued to ease in August, down to 39 from a revised 41 in July. This was the lowest reading since December 2023. Present sales condition and buyer traffic deteriorated, but sales expectations improved slightly.

Headline industrial production fell 0.6% in July following gains in May and June. Utility output was down sharply and mining activity was flat. Manufacturing output declined 0.3%. The Federal Reserve estimates that impacts from Hurricane Beryl held down July manufacturing output by 0.3%. Sharply lower motor vehicle output during the month sliced off another 0.6%. Performance was mixed within industries. Capacity utilization fell 0.6 points to 77.8%. A year ago, capacity utilization was 79.0%.

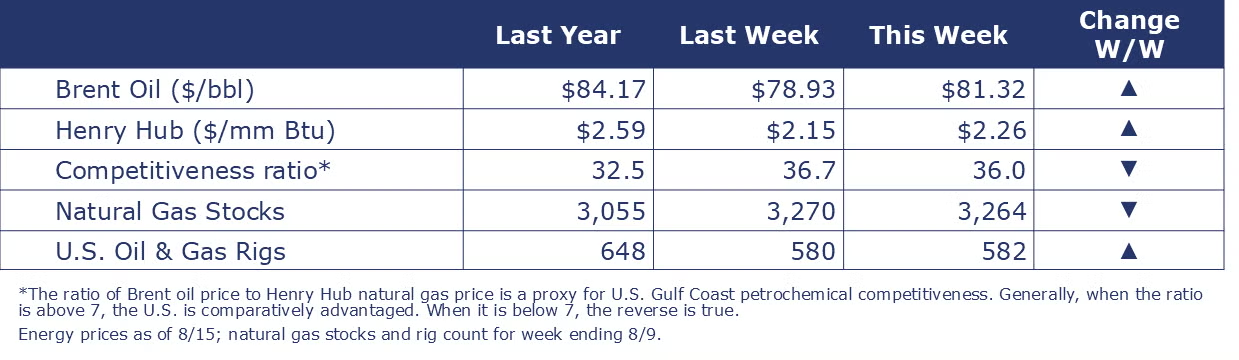

Despite continued concerns about the global economy, oil prices moved higher this week as analysts fear an Iranian strike against Israel if renewed ceasefire discussions are unsuccessful. U.S. natural gas prices were also higher, in part due to a rare 6 BCF draw in gas inventories last week as hot weather boosted power demand and production curtailments limited new supplies. Despite last week’s drawdown, EIA is projecting that natural gas inventories will reach 3.954 trillion cubic feet by the end of October, the highest in eight years. Combined oil and gas rigs rose by two to 582.

Indicators for the business of chemistry suggest a yellow banner.

According to data released by the Association of American Railroads, chemical railcar loadings were down to 32,959 for the week ending 10 August. Loadings were up 2.5% Y/Y (13-week MA), up (4.3%) YTD/YTD and have been on the rise for eight of the last 13 weeks.

Chemical production fell 0.9% in July as Hurricane Beryl disrupted activity, especially along the U.S. Gulf Coast where it made landfall on July 8th. There were broad declines in the output of basic industrial chemicals which were the most directly impacted from hurricane-related disruptions. Plastic resin production was also sharply lower, but output of synthetic rubber and manufactured fibers rose. There were also gains in the production of fertilizers, crop protection chemicals, consumer products and other specialty chemicals. Capacity utilization for chemicals fell 0.8 points to 77.8% and was lower than last July’s 78.9%.

Producer prices for chemicals rose 0.7% in July, the fourth consecutive monthly gain. Prices were higher for organic chemicals, plastic resins, and other specialty chemicals. These gains were partially offset by lower prices for inorganic chemicals, synthetic rubber, manufactured fibers, and agricultural chemicals. Prices for coatings and consumer products were unchanged compared to June. Feedstock prices rose 13.2% during the month. Compared to a year ago, chemical prices remained off by 0.5%.

Chemical import prices fell by 0.7% in July, following a 0.3% gain in June. Prices for chemical exports rose, however, up by 0.1%. Compared to a year ago, chemical import prices were lower by 2.9% Y/Y while export prices were 0.7% Y/Y higher.