Economic Factors

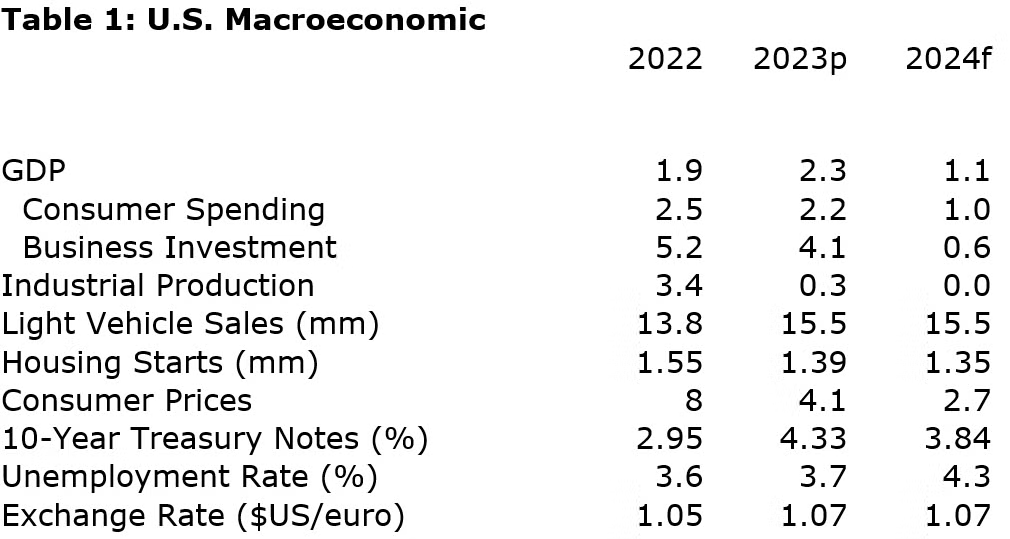

Moving into the end of the year, the momentum that has propelled the U.S. economy during 2023 is starting to fade. Despite robust growth in U.S. GDP during Q3, the U.S. economy is slowing down. Following a year and a half of interest rate increases, inflation and the labor market are cooling. One of the most highly anticipated economic slowdowns is around the corner.

Consumer spending has been surprisingly resilient this year, though a larger share of spending has been on services, e.g., travel, entertainment, and restaurants. That spending was supported by higher real wages and excess savings from the pandemic. But as the end of the year draws close, consumers are starting to feel the strain of high prices, high borrowing costs, the resumption of student loan repayments, and the erosion of the cushion of pandemic savings that has fueled consumer spending over the past several years. Following a 2.2% gain in consumer spending in 2023, we expect growth to slow to 1.0% in 2024.

Business investment, spurred, in part, by recent legislation (e.g., Inflation Reduction Act, CHIPS Act), rose 4.1% in 2023. Business investment is expected to slow to a 0.6% gain in 2024 as higher borrowing costs, tighter lending standards, and slower consumer spending weigh on firms.

Unemployment has edged higher as one of the tightest labor markets in recent history is starting to loosen. Inflation has come down steadily but remains above the Fed’s preferred target. While price growth continues to slow, the Fed has not ruled out future increases.

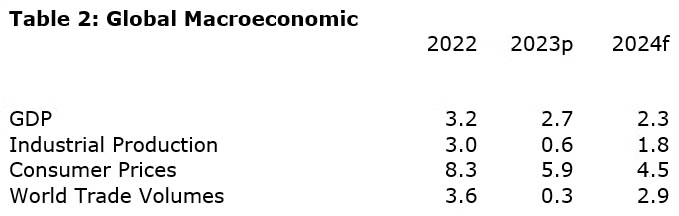

Globally, higher interest rates have slowed growth in most parts of the world. Global GDP is projected to expand 2.7% this year (2023) and to slow further to a 2.3% pace in 2024. While growth slowed across most regions compared to 2022, growth in parts of Asia accelerated as China emerged from its zero-COVID policies at the end of last year.

Global trade has slowed notably, as world demand for goods remains weak following the pandemic-driven spending binge and subsequent inventory building in response to severe supply chain disruptions. Trade volumes were essentially flat in 2023, up just 0.3%. In 2024, we expect trade volumes to grow to 2.9%.

Across a number of indicators (including purchasing managers indices), global manufacturing contracted in 2023 in many countries. Global industrial output rose 0.6% in 2023 and growth is expected to pick up, up by 1.8% in 2024.

End Use Markets

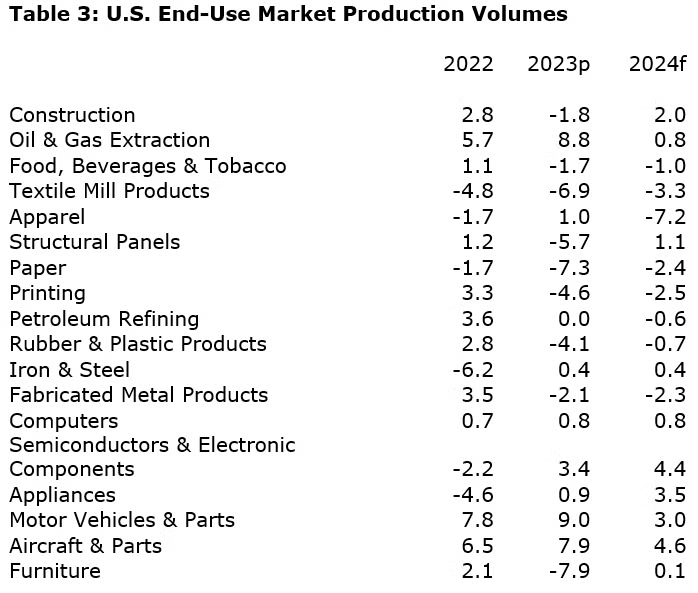

More than 85% of basic and specialty chemicals are consumed by the industrial sector and the outlook for industrial production remains weak. Overall industrial production rose just 0.3% in 2023 with flat growth expected in 2024. An industrial rebound begins at the end of 2024 and accelerates into 2024.

In the U.S., the ISM Manufacturing PMI® signaled contraction in U.S. manufacturing throughout much of the year. Performance in the industrial sector has been uneven with seven of 18 key chemistry-consuming industries contracting in 2023. Automotive and aerospace were bright spots in an otherwise lackluster manufacturing sector.

With more than $4,000 of chemistry products in the average automobile, the six-week UAW strike had only a limited impact on chemistry demand. Following three years of low vehicle availability, due first to the pandemic and then to a global shortage of semiconductors, vehicle sales recovered in 2023 to 15.5 million, a level still below the pre-pandemic average. With higher borrowing costs and uncertain economic conditions, growth in vehicle sales is expected to be flat in 2024 (at 15.5 million). Chemistry-intensive electric vehicles account for a larger share of vehicle sales in the U.S., up to nearly 8% of new sales in Q3, according to Cox Automotive.

Another important end-use market for chemistry is housing, in the form of energy-saving insulation, protective coatings, sealants, vinyl siding, resilient flooring, and roofing materials, just to name a few. Following a surge of building activity during the pandemic, interest-rate sensitive housing was among the first sectors to turn down when the Fed began raising interest rates in March 2022. As mortgage rates climbed, however, existing homeowners who had financed with much lower rates became “locked” into their existing mortgages, creating disincentives to move. As a result, existing home inventories have become historically lean, leading some homebuyers into the new build market, providing some support for housing starts. Housing starts fell from 1.55 million in 2022 to 1.39 million in 2023. With rising unemployment and high borrowing costs, we expect housing will edge lower to 1.35 million in 2024.

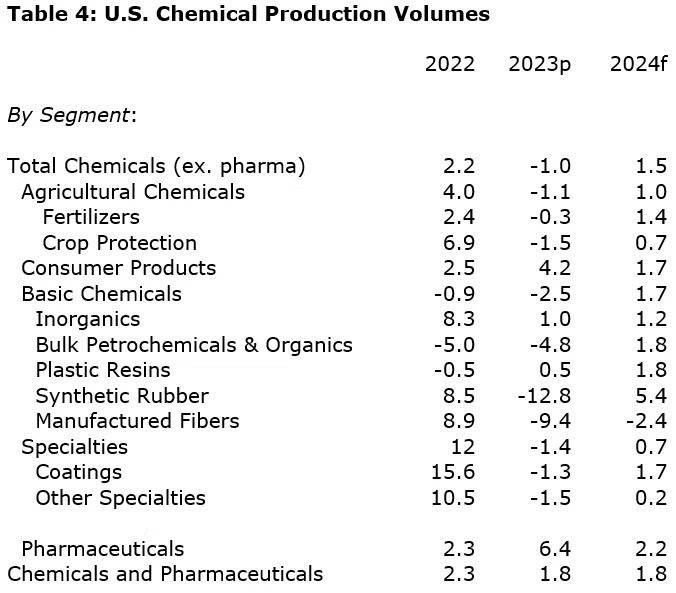

Chemical Production

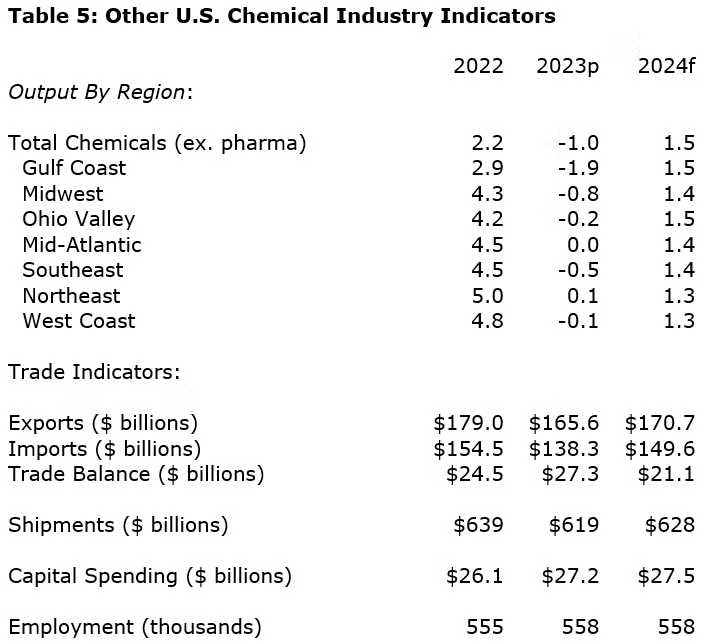

An unprecedented destocking cycle that began in Q3 ’22, and continued through much of this year, curbing production. Coming into the end of the year, inventory destocking has largely been resolved, but signs of customer restocking have yet to materialize. Compared to 2022, we expect chemical output volumes to fall 1.0% in 2023 with lower output in all chemistry segments except consumer products. Within the U.S., the largest declines were in the Gulf Coast region. In 2024, we expect a modest recovery in all segments with overall chemistry output growing by 1.5%. This is consistent with the findings of ACC’s Economic Sentiment Index that found chemical firms felt that overall business activity and major customer demand deteriorated in Q3 but were expected to improve over the next six months. Because of the chemical industry’s early position in the supply chain, we would expect to see a turnaround in chemicals before improvement in the broader economy.

Output of basic chemicals in the U.S. fell 2.5% in 2023 with declines in petrochemicals and organic intermediates, synthetic rubber, and manufactured fibers output. Slightly higher production of plastic resins, which were up by 0.5%, resulted from stronger exports. Specialty chemical output was also lower 2023 with declines in coatings and other specialty chemical categories. We also saw declines in fertilizers and crop protection chemicals. Production of consumer products benefited from higher consumer spending and was up 4.2%.

The longer-term outlook for U.S. chemistry is positive with the natural gas liquids feedstock advantage continuing to favor U.S. production for the foreseeable future. In addition, capacity expansions in customer industries motivated by recent legislation (e.g., IRA, IIJA, CHIPS) and re-/near-shoring of manufacturing to North America will support U.S. chemistry going forward.

Following two years of double-digit growth, external demand for manufactured goods and chemical inputs has softened. Weakness in the economic environment and the industrial sector, especially, resulting in a 7.5% decline in U.S. chemical exports in 2023 followed by 3.1% growth in 2024. U.S. chemical imports also declined this year, by 10.5%, but are expected to grow by 8.2% in 2024. The U.S. continues to maintain a trade surplus in chemicals throughout the forecast horizon.

Capital spending slowed to a 4.3% gain in 2023 to $27.2 billion and growth is expected to slow to 1.1% in 2024 as higher borrowing costs dampen investment. A quarter of ACC member companies reported that a quarter of their capital budgets were allocated towards sustainable manufacturing.

Chemical industry employment surged in 2022 with the industry gaining more than 18,000. In 2023, employment continued to rise (up by 3,000), reflecting the tight labor market situation. Employment is expected to remain stable in 2024 before moving higher in 2025.

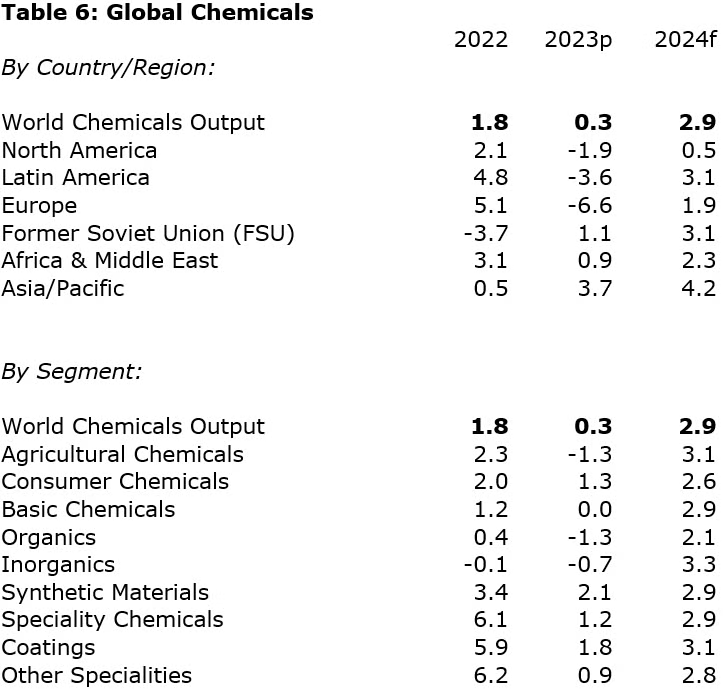

Globally, chemical production expanded by 0.3% in 2023 with the largest gains in Asia/Pacific. Chemical output in Africa & Middle East and the former Soviet Union countries also rose offsetting production declines in Europe, North America and Latin America. Stronger growth of 2.9% is expected in 2024 as global industrial production picks up.

Longer-Term Outlook & Risks

Moving beyond the short-term downturn, prospects for U.S. chemistry remain positive with competitive energy fundamentals and the resurgence in U.S. manufacturing from once-in-a-generation legislative initiatives to promote clean energy, infrastructure, and a strong domestic manufacturing base.

Of course, there are several risks to the outlook, including the threat of rising regulatory impact on the chemical industry in the U.S. that could undermine competitive advantages in energy and opportunities provided by the manufacturing expansion. If these regulatory imbalances are not addressed, it could incentivize companies to move production offshore.

In addition, policy mistakes by the Fed (i.e., keeping rates higher for longer or raising them more than necessary) remain a concern. In addition, additional geopolitical conflicts, unexpected financial volatility, external shocks (i.e., weather, cyberattack, etc.) could also disrupt the outlook.

The full data set with historic trends and forecasts through 2026 is available to ACC members on ACCexchange and to others on the ACC Store.

Reasonable effort has been made in the preparation of this publication to provide the best available information. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.